12th June 2020

The worries of COVID – 19 and the Impact it will have on Property Development

There is a lot happening with the house prices in the UK right now. There are two websites you can use to check the house prices in the UK one is www.nethouseprices.com and then there is google land registry house price data where you can go to the land registry website and see for yourself what the prices are. People say house prices go up more in the South than they do in the North of England so what is the average in different areas? Over time what you find when you look into this is actually the North goes up the same as the South of England when you look at it in percentage terms. If you have a property that is worth a £1 million in London, £1 million in Birmingham, £1 million in Newcastle over time they go up the same. However the Newspapers are based in London so they report on the London prices the most where they say the average house has gone up by £30,000. Whereas people in the North then say my house will never go up by £30,000! However it does not necessarily need to go up by £30,000 a 10% increase in London would be £30,000 however a 10% increase in Newcastle is £8,000 therefore it is about the portfolio size and the percentage increase.

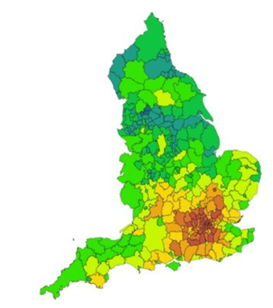

So if it goes up the same in the North then the south how does that work? In the last 5 or 6 years if you look into it London is up by 80% in growth terms. It fluctuates slightly in different areas within London however 80% growth is the average within the city. This then washes out to the outer Metropolitan of London which up by 40-50%, then East Anglia which is up by 45% then it goes down to South West which is 38% and the Midlands is up 20%. Then the M62 corridor and Newcastle is up by 6% in that six year period. However professional investors understand it is a wave. It goes up first in London and then along the motorway network to the next area and so on and so forth. It also is like a wave when it stops. Firstly it slows down in London and then spreads like a wave. Then it stops and even drops in London first for instance like in 2007-2008 and then washes out and drops in other places. Over time it goes up the same it is just if the £1 million property doubles in the next 10 years in London then the Midlands might be 3 years behind and the M6 corridor may be 3 or 4 years behind London, Newcastle might be behind London but it will still double over the next 10 years.

For that reason serious professional investors with millions of pounds worth of property in London are going to the Midlands and the M62 corridor because they know they are the next areas within the wave to go up. They know London is reaching the higher part of its price range or will do within the next 2 or 3 years. But these investors are saying if we purchase in the Midlands we have 60% growth to catch up plus the 2 or 3 years of growth. Therefore better purchasing in those areas to maximise the uplift. However the long term picture is not about catching the wave because if you are holding property for the long term it does not matter where in the wave you are when you buy it is just a matter of the sooner you are in the better because you are benefiting from cash flow and you are benefiting from equity uplift.

As an investor you want both to be at the table but both will not be at the table every year what matters over time is that both are at the table. Hence when purchasing you have to makes sure they have good cashflow and that you purchase a property within a location which covers the national average of uplift in prices. The key to purchasing property as an investor for the long term is to obtain good cash flow and also picking properties in the right locations so you can also benefit from the uplift in value overtime and maximise your equity.

Best of Luck!

Leave a comment